As the cryptocurrency market is becoming the mainstream of finance, coin utility has become one of the most reliable indicators of long-term value. Early crypto cycles were dominated by narratives, speculation, and price momentum. But now the crypto market is slowly shifting towards the real world utility.

Recently Vitalik Butterin mentioned that – “If crypto keeps centering on gambling without any real world use cases, the crypto industry will die fast”

This urges the need for the coin utility, metrics and use cases in cryptocurrency coin utility. Today, businesses, investors, and platforms are far more focused on what a token actually does, how often it is used, and whether that usage can sustain itself through market cycles.

Coin utility or cryptocurrency coin governance models is not just a concept in papers anymore, it is a practical framework used to assess risk, prioritize integrations, and allocate capital. This article explores how real coin utility is evaluated in practice, the metrics that matter, common pitfalls, and how AI is reshaping utility analysis at scale.

Why Coin Utility Matters in a Maturing Crypto Market

Utility is a general phrase in crypto coin vs token that usually means how valuable a cryptocurrency or token is in a certain ecosystem or outside of it. There are more and more types of cryptocurrencies. Some are aimed for basic transactions (like Bitcoin), while others are meant for more complicated systems (like Ethereum or Solana).

The value of a cryptocurrency coin utility might change a lot based on how useful it is. A token that has actual, useful uses tends to have more users. Some common uses for crypto are:

- Transactional tokens, like Bitcoin and Litecoin, are mostly used to trade.

- Tokens like Ethereum, Cardano, and Solana support decentralized applications (dApps) and decentralized financing (DeFi) services on smart contract platforms.

- Governance tokens are tokens like Uniswap (UNI) and Compound (COMP) that give holders the right to vote on protocol decisions.

- Stablecoins, like USDT and USDC, are linked to a fiat currency and are widely used for trading, payments, and DeFi apps.

What are Utility Tokens?

Utility tokens are digital assets based on blockchain technology that let you use certain features or services in a certain cryptocurrency coin utility. Utility tokens are different from Bitcoin because they are used to power decentralized systems, while Bitcoin is mostly used as a store of value or a way to send money.

This is the most important difference: utility tokens give you the right to use something, not own it. If you have a utility token value for a decentralized storage network, you can buy storage space or processing power. If you own a governance token for a DeFi protocol, you can vote on how that protocol will change in the future.

Experts call the “utility-payment-value” chain the “value proposition.” The value of real utility tokens should stay the same as more people start using them, rather than just going up and down because of speculative trading.

Utility tokens are usually given out in a number of ways:

- Initial Coin Offerings (ICOs): Projects get money by selling tokens before they go live.

- Initial Exchange Offerings (IEOs): Exchanges check and list tokens directly.

- Airdrops: Giving away free stuff to early users or members of the community

- Token Swaps: people who already own tokens trade them for fresh protocol tokens.

Most token use cases follow standard rules, like ERC-20 on Ethereum. This makes sure that they work with all wallets and exchanges while also keeping security requirements high.

Utility Metrics That Matter

Active Addresses

Transaction Volume and Frequency

Network Fees

Total Value Locked (TVL)

Developer Activity

Real-World Partnerships and Integrations

Real-World Use Cases of Cryptocurrency Coin Utility

Payments

DeFi Protocols

In decentralized finance, tokens function as:

- Collateral

- Governance instruments

- Fee and reward assets

- Liquidity coordination tools

Analysts focus on how critical the token is to protocol operation, not just total value locked (TVL).

Gaming and Virtual Economies

Gaming ecosystems rely heavily on tokens for:

- In-game economies

- Asset creation and trading

- Player incentives

NFTs and Digital Ownership

Infrastructure Tokens

Enterprise Blockchain Adoption

The Future of Crypto Utility and Adoption

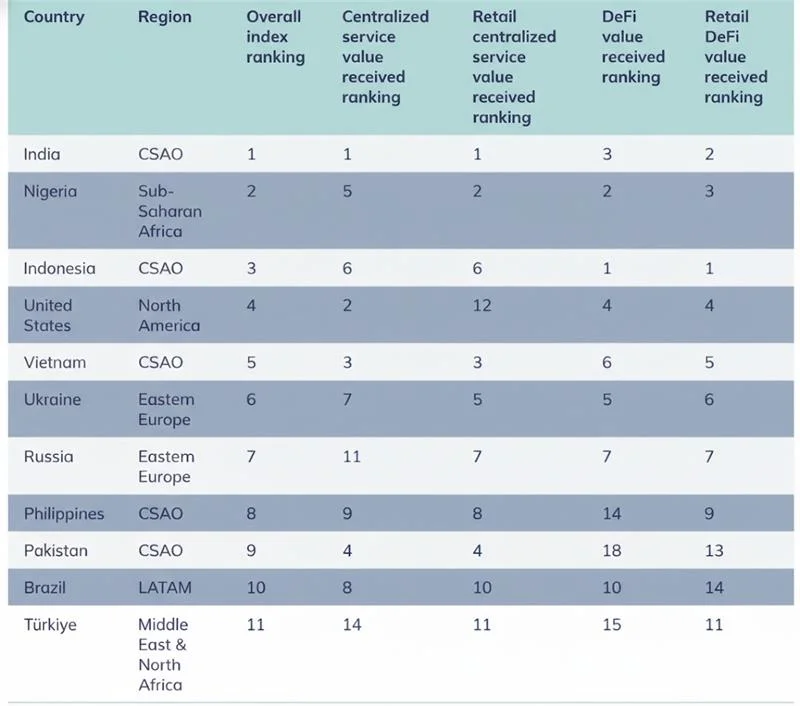

According to Chainalysis’s 2024 Global Crypto Adoption Report, Central and Southern Asia and Oceania (CSAO) are the most popular places in the world for using cryptocurrencies. Seven of the top 20 countries are in this region. The survey also shows that global crypto activity has grown a lot, mostly thanks to countries with lower-middle incomes.

The launch of the Bitcoin ETF in the US led to a huge increase in the number of Bitcoin transactions around the world. This was especially true for large-scale institutional transfers and areas with higher-income economies, such as North America and Western Europe.

As the industry changes, a number of things could lead to the next wave of cryptocurrency coin utility use and adoption:

- Layer-2 Solutions: Ethereum’s Layer-2 solutions, such as Optimism and Arbitrum, are meant to make transactions cheaper and faster, which makes the user experience better.

- Central Bank Digital Currencies (CBDCs): Countries like China are testing a digital yuan. CBDCs might use blockchain to make routine transactions happen all across the world.

- Interoperability between chains: Projects like Polkadot and Cosmos are working on making chains function together, which might make things easier for users and help them adopt the technology more widely.

How AI Improves Coin Utility Analysis

As the number of digital assets grows, manual analysis becomes impractical. AI-driven analytics are increasingly used to evaluate crypto utility at scale.

AI systems aggregate on-chain and off-chain data, normalize metrics across networks, and filter out noise. Predictive models help forecast adoption trends, while automated signal detection identifies:

- Early growth inflections

- Governance shifts

- Unusual activity patterns

AI does not replace human judgment, it enhances it by improving consistency, speed, and coverage.

Business Opportunity: Utility Analysis at Scale

Exchanges, funds, and Web3 startups increasingly rely on AI-powered tools to assess coin utility across hundreds or thousands of assets.

These platforms support:

- Asset listing and delisting decisions

- Portfolio construction and risk management

- Protocol integration analysis

- Market intelligence and reporting

At scale, utility analysis becomes a strategic advantage rather than a research task.

Why Choose Shamlatech

Shamlatech, a crypto coin development company specializes in building custom AI-driven crypto analytics systems tailored to business needs and create a Cryptocurrency Coin. Instead of generic dashboards, we design solutions that align with how your organization evaluates risk, adoption, and opportunity.

Our expertise includes:

- AI-powered on-chain analytics platforms

- Coin utility scoring and dashboards

- Predictive adoption and risk models

- Trading and market intelligence systems

We help businesses move from fragmented data to actionable insight.

Build Utility Intelligence That Scales

If your organization needs to evaluate cryptocurrency coin utility across large asset universes, custom AI-powered analytics platforms can provide clarity and speed.

Whether you want to build a cryptocurrency coin .

- Coin utility dashboards

- Predictive adoption models

- Trading and risk intelligence systems

Integrated on-chain analytics solutions