The world of finance is rapidly evolving, and Real World Asset Tokenization is at the forefront of this transformation. By converting tangible and intangible assets into digital tokens, investors can now own, trade, and manage fractions of high-value assets with ease. From real estate and commodities to gold, private equity, and art, the different types of real-world assets can be tokenized and continue to expand. This revolutionary approach enhances liquidity, transparency, and accessibility in markets that were once limited to institutional players.

Whether it’s tokenized real estate, tokenized commodities, or tokenized securities, asset tokenization is reshaping traditional investment models and bridging the gap between the physical and digital economies—ushering in a new era of democratized, borderless, and programmable finance. In this blog, let’s explore the major types of real-world assets can be tokenized, their market relevance, and how the ERC-1400 standards for tokenized assets ensure secure, compliant, and programmable digital ownership.

Understanding Real World Asset (RWA) Tokenization

Real World Asset (RWA) Tokenization is the process of converting physical or tangible assets—such as real estate, gold, bonds, or art—into digital tokens on a blockchain. Each token represents ownership, value, or a share of the underlying real-world asset. These tokenized assets can be traded globally, allowing fractional ownership, faster settlement, and enhanced transparency. Unlike traditional investment models, real world asset tokenization eliminates intermediaries, lowers entry barriers, and provides 24/7 market access. As blockchain adoption grows, the types of real-world assets can be tokenized and continue to diversify, covering various sectors.

The use of ERC-1400 standards for tokenized assets ensures compliance, regulatory control, and interoperability across financial ecosystems. RWA tokens bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), enabling institutions and individuals to participate in high-value markets once reserved for a few. As adoption grows, tokenization stands as the cornerstone of the future digital economy—uniting security, efficiency, and inclusivity in asset ownership.

Why Tokenize Real-World Assets?

Tokenizing real-world assets unlocks several benefits:

Benefit | Description |

Liquidity | Converts traditionally illiquid assets like real estate or art into tradable digital tokens. |

Accessibility | Enables fractional ownership, allowing small investors to access premium asset classes. |

Transparency | Blockchain ensures verifiable and tamper-proof ownership records. |

Efficiency | Reduces intermediaries, automating processes like transfer and settlement. |

Compliance | Standards like ERC-1400 support built-in regulatory compliance and investor protection. |

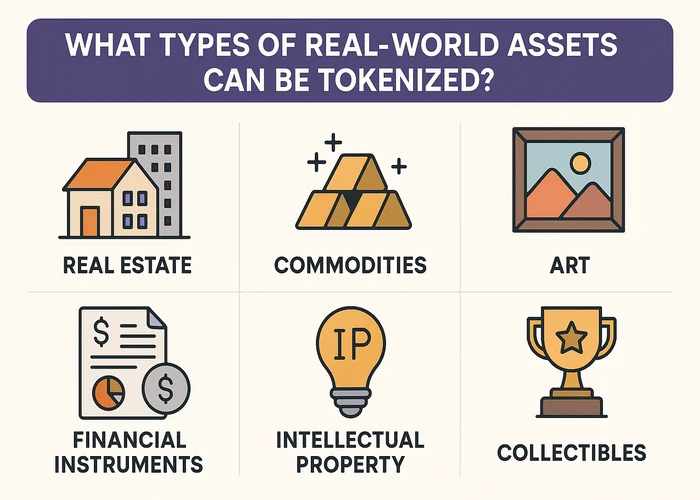

What Types of real-world assets can be tokenized?

Blockchain technology is redefining how the world perceives ownership and investment. Through real world asset tokenization, tangible and intangible assets are now being digitized into blockchain-based tokens — offering liquidity, global access, and verifiable proof of ownership.

But what exactly are the types of real-world assets can be tokenized, and how do standards like ERC-1400 standards for tokenized assets ensure regulatory compliance and interoperability? Let’s find out in detail.

1. Real Estate – Fractionalized Global Property Ownership

Real estate tokenization remains the most prominent example of real world asset tokenization, enabling investors to own fractional shares of global properties.

How It Works

- Properties are legally digitized into blockchain-based tokens.

- Each token represents a verifiable ownership fraction in real-world property.

- Smart contracts automate rent, dividend distribution, and title transfers.

- Blockchain records ownership transparently, reducing fraud and paperwork.

Real Examples

- RealT (USA): Ethereum-based platform for tokenized rental income.

- Propy: Executes on-chain real estate NFT transactions and digital title deeds.

Key Features

- Fractional ownership & increased liquidity

- Cross-border investment opportunities

- Lower entry barriers for retail investors

- Automated compliance under ERC-1400 standards for tokenized assets

Development Insights

A Real Estate Tokenization Development platform should:

- Integrate KYC/AML and accredited investor verification.

- Use oracles for real-time property valuation.

- Enable secondary market liquidity pools.

- Comply with land registry regulations and smart contract audits.

2. U.S. Treasury Bonds – Digital Government Securities

Among the most trusted types of real-world assets can be tokenized, U.S. Treasury Bonds represent stable, government-backed debt digitized for faster settlement and broader access.

How It Works

- Bonds are issued as compliant tokenized securities using ERC-3643 or ERC-1400 standards for tokenized assets.

- Investors earn periodic interest via automated smart contracts.

- Token holders can trade anytime without traditional clearing delays.

Real Examples

- Franklin Templeton’s BENJI Fund: Tokenized U.S. Treasury fund on Ethereum.

- Ondo Finance: Provides tokenized treasury-backed stable yield assets.

Benefits

- Low-risk, yield-bearing tokenized assets.

- Institutional-grade transparency and programmability.

- Instant settlements and fractional access to government securities.

Development Insights

For a Treasury Bonds Tokenization platform:

- Build smart contracts supporting dividend distribution.

- Implement real-time NAV calculations via oracles.

- Enable on-chain regulatory reporting for institutional investors.

3. Gold and Precious Metals – Digital Bullion with Proof-of-Reserves

Gold has been a store of value for centuries — and now tokenized gold combines its timeless value with blockchain transparency.

How It Works

- Each token equals a certified quantity of vault-stored metal.

- Blockchain records ensure proof-of-reserves and full traceability.

- Users can redeem tokens for physical gold or trade digitally.

Real Examples

- PAX Gold (PAXG): 1 token = 1 fine troy ounce of LBMA gold.

- Tether Gold (XAUT): Gold-backed token stored in Swiss vaults.

Advantages

- 24/7 global access to tangible, inflation-resistant assets.

- On-chain proof-of-reserves verified by external auditors.

- Reduced storage and logistics challenges.

Development Insights

To launch a Gold RWA Tokenization platform:

- Connect audited vault APIs and real-time pricing feeds.

- Use multi-jurisdiction custody models for compliance.

- Apply ERC-1400 standards for tokenized assets for investor safety.

4. Private Credit – Digital Lending for SMEs

Private credit tokenization converts debt instruments and SME loans into digital securities, improving liquidity and access to private lending markets.

How It Works

- Loan agreements are recorded as blockchain tokens.

- Investors fund credit pools and receive interest payments.

- Smart contracts automate risk tracking and repayment.

Real Examples

- Centrifuge (Tinlake): Tokenizes SME loans for DeFi liquidity.

- Maple Finance: Institutional-grade lending powered by RWA tokens.

Benefits

- High-yield, fixed-income RWA tokens.

- Transparent risk analytics and default tracking.

- Diversified exposure to private debt markets.

Development Insights

A Private Credit Tokenization Platform should:

- Use decentralized credit scoring.

- Automate repayment and collateral enforcement.

- Support MiCA and ISO 20022 compliance.

5. Corporate Bonds – Tokenized Institutional Debt

Corporate bonds are one of the fastest-growing types of real-world assets can be tokenized, offering programmable interest and instant settlements.

How It Works

- Companies issue bonds digitally through compliant security tokens.

- Investors receive automated coupon payments on-chain.

- Tokenized bonds reduce settlement delays and improve liquidity.

Real Examples

- Bitbond: Pioneering blockchain-based bond issuance under German law.

- UBS Tokenized Bonds: Issued via blockchain for institutional clients.

Features

- Instant settlement and reduced costs.

- Smart contract-driven governance.

- Global access to corporate debt products.

Technical Edge

Using ERC-1400 standards for tokenized assets, platforms can:

- Enforce transfer restrictions.

- Partition ownership for compliance.

- Provide transparent auditability for regulators.

6. Commodities – Digitized Energy, Metals & Agriculture

Tokenized commodities allow fractional ownership in real-world goods like oil, copper, wheat, or silver, offering exposure to physical trade markets.

Real Examples

- SEBA Bank (Switzerland): Tokenizing metals and oil for investors.

- Agrotoken: Represents grain and agricultural commodities as tokens.

Benefits

- Enhanced liquidity for traditionally bulky assets.

- Real-time pricing using Chainlink oracles.

- Cross-border trade with minimal intermediaries.

Development Insights

A Commodities Tokenization Development platform should:

- Integrate warehouse receipt verification.

- Offer asset-backed collateralization mechanisms.

- Ensure regulatory compliance across jurisdictions.

7. Art & Collectibles – Democratizing Luxury Ownership

Art tokenization opens global access to fine art, collectibles, and luxury assets, making cultural investments accessible to everyone.

How It Works

- Each art piece or collectible is fractionalized as tokens.

- Ownership, provenance, and valuation data are recorded on-chain.

- Investors can trade or hold fractions tied to verified artworks.

Real Examples

- Masterworks: Tokenizes fine art from artists like Picasso and Monet.

- Artex: Provides blockchain-based fine art exchange and authentication.

Advantages

- Retail access to blue-chip collectibles.

- Immutable on-chain provenance.

- Secure digital trading using NFTs or security tokens.

Development Insights

An Art Tokenization Platform Development should include:

- Custody partnerships for physical asset storage.

- IP verification for authenticity.

- Integration with ERC-721 and ERC-1400 smart contracts.

8. Private Equity – Liquidity in Venture Capital

Private equity tokenization bridges traditional venture capital and DeFi by enabling fractional ownership of private companies and funds.

Real Examples

- Securitize: Tokenizes private funds for global investors.

- Hamilton Lane: Brings institutional-grade PE investments on-chain.

Benefits

- Liquidity for illiquid investments.

- Broader investor participation in private markets.

- Fully compliant digital fundraising and ownership transfer.

Development Insights

For a Private Equity Tokenization platform:

- Support programmable vesting schedules.

- Implement investor accreditation logic.

- Enable multi-chain deployment using ERC-1400 standards for tokenized assets.

9. Carbon Credits – Sustainable ESG Assets

As green finance expands, carbon credits are among the leading types of real-world assets can be tokenized, promoting environmental transparency.

Real Examples

- Toucan Protocol: Tokenizes verified carbon credits.

- KlimaDAO: Enables DeFi trading of on-chain carbon assets.

Benefits

- Verifiable ESG tracking and offset transparency.

- Automated retirement and reissuance of carbon tokens.

- Compliance with UN and ISO climate standards.

Development Insights

A Carbon RWA Tokenization system should:

- Integrate third-party ESG verification APIs.

- Support on-chain carbon tracking dashboards.

- Adhere to green finance and sustainability regulations.

10. Intellectual Property (IP) – Monetizing Innovation

Intellectual property tokenization empowers creators to fractionalize and monetize music, patents, or creative rights.

Real Examples

- io: Tokenizes music royalties from artists like Nas.

- Bolero Music: Blockchain-based IP and licensing platform.

Advantages

- Transparent royalty distribution.

- Fractional ownership in revenue-generating IP.

- Direct fan and investor participation.

Development Insights

An IP Tokenization Platform should:

- Use verifiable licensing frameworks.

- Employ zero-knowledge proofs for IP privacy.

- Support ERC-1400 for legal enforceability of revenue-sharing.

Comparative Overview – Tokenization Categories & Standards

Asset Type | Example Projects | Primary Blockchain Standard | Key Feature |

Real Estate | RealT, Propy | ERC-1400, ERC-3643 | Fractional ownership |

Treasury Bonds | Franklin Templeton, Ondo Finance | ERC-3643 | Yield-bearing security tokens |

Gold & Metals | PAXG, XAUT | ERC-20, ERC-1400 | Proof-of-reserve |

Private Credit | Maple, Centrifuge | ERC-1400 | Automated lending |

Corporate Bonds | Bitbond, UBS | ERC-3643 | Smart compliance |

Commodities | SEBA Bank, Agrotoken | ERC-1400 | Fractional commodity access |

Art & Collectibles | Masterworks, Artex | ERC-721 | Provenance & fractional NFTs |

Private Equity | Securitize, Hamilton Lane | ERC-1400 | Fund tokenization |

Carbon Credits | Toucan, KlimaDAO | ERC-20 | ESG verification |

Intellectual Property | Royal.io, Bolero | ERC-1400 | Royalty distribution |

ERC-1400 standards for tokenized assets

Why ERC-1400 Matters in Tokenization

- Partitioned ownership & investor compliance

- Whitelist-based transfer control

- Off-chain data validation and auditability

- Compatibility with ERC-20 and ERC-3643 ecosystems.

By following ERC-1400, every project ensures that the types of real-world assets can be tokenized remain legally enforceable, interoperable, and institutionally ready.

Future of Tokenized Real-World Assets

The future of tokenized real-world assets is rapidly unfolding as blockchain adoption and global regulations mature. In the coming years, the types of real-world assets can be tokenized will extend far beyond traditional categories reaching into emerging sectors such as digital identity, data-backed assets, and more.

By leveraging the ERC-1400 standards for tokenized assets, future tokenization ecosystems will ensure every asset is compliant, transparent, and interoperable across jurisdictions. This next phase of real world asset tokenization will transform how individuals, institutions, and nations interact with value — turning illiquid markets into liquid ecosystems and bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi). In essence, the types of real-world assets can be tokenized will continue to grow until nearly every form of value can exist, move, and trade securely on-chain.

How Shamla Tech Empowers Real World Asset (RWA) Tokenization

At Shamla Tech, we specialize in building fully compliant, enterprise-grade Real World Asset (RWA) Tokenization Platforms tailored to diverse industries. Our expertise spans across all types of real-world assets can be tokenized — from real estate, commodities, and gold to private equity, art, and carbon credits. By integrating ERC-1400 standards for tokenized assets, we ensure every tokenized asset is secure, transparent, and regulator-ready.

Our end-to-end services include smart contract development, KYC/AML integration, asset valuation oracles, and secondary market creation for liquidity. We design scalable ecosystems that empower businesses, investors, and institutions to seamlessly convert real-world value into digital tokens. With deep technical expertise in DeFi, Web3, and blockchain compliance, Shamla Tech enables clients to launch next-generation tokenization solutions that bridge traditional finance with digital innovation — unlocking global accessibility, 24/7 trading, and trusted ownership for all real-world assets.