In blockchain technology, the real world asset tokenization has changed the asset digitization, trading online and other financial services. Many upcoming businesses comes into this fast-growing market should understand RWA tokenization platform costs.

This thorough overview covers RWA tokenization development expenses from strategy to deployment and operations.

Real World Asset tokenization company transforms asset management by turning real estate, commodities, artwork, and infrastructure into blockchain-based digital tokens. The global RWA tokenization market is expected to reach $16.1 trillion by 2030, making the cost of creating a platform a crucial investment for forward-thinking companies.

The difficulty of RWA tokenization platforms depends on asset kinds, legal restrictions, blockchain connectivity, and feature sophistication. Understanding development costs aids platform investment and business model creation for real estate tokenization and other asset classes.

In this blog, we will discuss about the cost to create a RWA Tokenization platforms in deep.

Understanding RWA Tokenization Platform Components

It is very important to understand the cost to create a RWA tokenization platforms and the basic components when you want to enter RWA tokenization business.

Real World Asset tokenization solutions or real estate tokenization digitize, manage, and exchange physical assets on blockchain networks using numerous integrated technologies.

Core Platform Parts:

- Asset appraisal and authentication systems for correct pricing and authentication

- Automation of token issuance and management with smart contracts

- Regulatory compliance modules for jurisdictional legality

- KYC/AML systems for user verification and compliance and investor onboarding

- Trading and liquidity management for secondary markets

- Asset management and custody for physical asset security

RWA tokenization platforms must use blockchain for transparency, security, and efficiency while integrating with traditional financial systems. The expense of creating a RWA tokenization platform is high since developers must assure compatibility with both legacy and modern blockchain technology.

The sophistication of Real World Asset tokenization platforms impacts development complexity and costs. Single-asset systems like real estate tokenization cost less than multi-asset, complicated derivative, and advanced trading platforms.

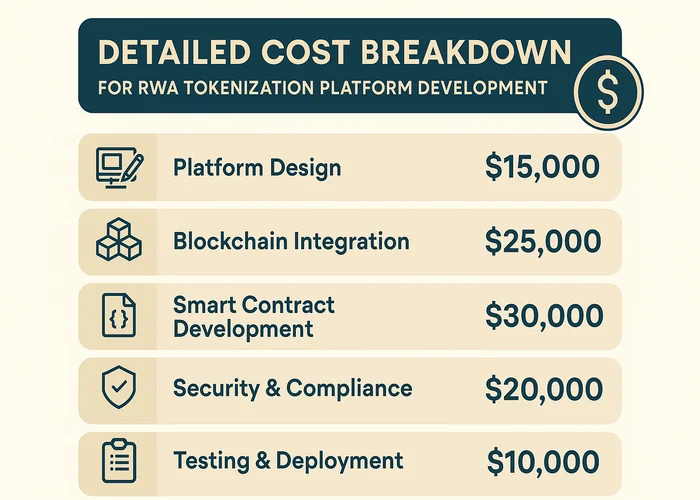

Detailed Cost Breakdown for RWA Tokenization Platform Development

Phase 1 Development Costs:

Platform Architecture and Design: $50,000-$150,000

Comprehensive architecture and user experience planning are the core of any successful RWA tokenization platform. Database design, API specifications, system architecture documentation, and user interface mockups are done in this phase. Real World Asset tokenization is complicated, thus scalability, security, and regulatory compliance must be planned from the start.

Smart Contract Development: $75-$250,000

RWA tokenization platforms automate asset tokenization, ownership transfer, dividend distribution, and compliance enforcement via smart contracts. Simple smart contracts for single asset types cost less than extensive frameworks covering numerous asset classes and sophisticated financial instruments to establish a RWA tokenization platform.

Blockchain Integration: $40,000–$120,000.

When it comes to cost to create a RWA Tokenization platforms, Blockchain integration demands knowledge and careful consideration of scalability, security, and cost. Multiple blockchain networks are used by Real World Asset tokenization platforms to optimize performance and cut transaction costs, complicating and costing development.

Core Feature Development Costs

Asset Valuation and Verification Systems: $60k–$200,000

Accurate asset valuation and verification are essential to RWA tokenization platforms. To cost to create a RWA Tokenization platforms, these systems must connect with traditional appraisal methods, real-time market data, and blockchain oracles. Property complexity and market changes necessitate sophisticated valuation methods for real estate tokenization.

Regulatory Compliance Framework: $80,000–$300,000.

Compliance is one of the biggest cost to create a RWA Tokenization platforms. Real World Asset tokenization services must follow securities, anti-money laundering, and local laws.

User Management and KYC/AML: $50,000–$150,000

Platform security and regulatory compliance are ensured via investor onboarding and verification. They must work with identity verification, background check, and regulatory reporting systems. Reall World Asset tokenization company solutions are complex and involve user administration for multiple investor types and compliance.

Cost of Advanced Feature Development

Trade and Marketplace: $100,000–$400,000

Secondary market trading provides liquidity and price discovery, boosting Real World Asset tokenization platform value. Cost to create a RWA Tokenization platforms and order matching engines, liquidity management tools, and market maker and exchange integration are needed to build advanced trading systems.

Custody and Asset Management: $70,000 – $250,000

Physical asset custody and management systems combine blockchain with traditional asset management. These systems must track physical assets, manage maintenance and enhancements, and ensure insurance and legal documents. Real estate tokenization needs extensive asset management.

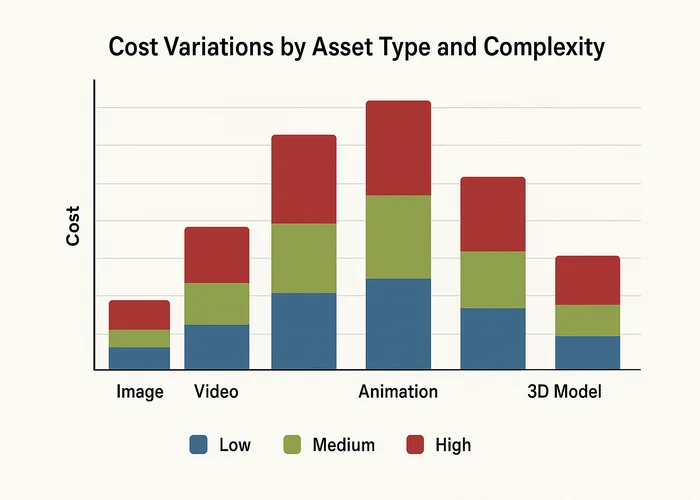

Cost Variations by Asset Type and Complexity

Real Estate Tokenization Platform Costs

Real World Asset Tokenization Development Companies and the cost to create a RWA Tokenization in Real Estate Investment

Basic Real Estate Platform: $300,000–$800,000.

Real Estate Tokenization How It Works for single properties include property appraisal, investor onboarding, token issuance, and basic trading. Residential and commercial properties are supported by these platforms with standardized tokenization and limited customization.

Advanced Real Estate Platform: $800,000–$2,000,000

Comprehensive real estate tokenization solutions allow different property types, complicated ownership structures, fractional ownership, rental income distribution, property management integration, and advanced trade mechanisms. Real World Asset Tokenization Development Companies for Real Estate create these complex platforms for institutional clientele who need full functionality.

Enterprise Real Estate Platform: $2,000,000–$5,000,000+

Large real estate enterprises, REITs, and institutional investors use enterprise-level platforms for portfolio administration, complex financial instruments, regulatory reporting, and integration with enterprise systems. These systems are the best real estate tokenization platforms, with bespoke functionality and regulatory compliance.

Multi-Asset Tokenization Platform Costs

Here are the cost to create a RWA Tokenization platforms and multi asset tokenization platform

Commodity Tokenization Platforms: $400,000 – $1,200,000

Gold, oil, agricultural products, and precious metal platforms need supply chain tracking, quality verification, storage management, and commodity exchange integration. Connecting actual storage and commodity trading systems to a commodity RWA tokenization platform costs money.

Art and Collectibles Platforms: $350,000–$1,000,000

RWA tokenization for art and collectibles involves advanced authentication, provenance, condition monitoring, and art market database connectivity. These platforms must enable fractional ownership of valuable things with sufficient custody and insurance.

Equipment and Infrastructure Platforms: $500,000–$1,500,000

Performance monitoring, maintenance tracking, revenue distribution, and operational system integration are needed to tokenize infrastructure assets like renewable energy projects, transportation equipment, and industrial machinery. These solutions commonly include IoT for real-time asset monitoring and data collection.

Tech stack and costs

The technology stack choice greatly affects RWA tokenization platform creation and operational costs. Technology infrastructure for Real World Asset tokenization must handle huge transaction volumes, strict security, and complicated business logic.

Blockchain Platform Budget: Ethereum Integration: $50,000-$150,000

Ethereum is the most popular blockchain for RWA tokenization due to its mature smart contract environment and developer support. High-volume platforms may face operational difficulties due to gas pricing and scalability issues. Integration costs include smart contract development, testing, and gas efficiency optimization.

Alternative Blockchain Integration: $40,000–$120,000.

For Real World Asset tokenization, Polygon, Binance Smart Chain, and Solana offer cheaper transaction costs and greater throughput. Integration complexity depends on platform maturity and development tools, affecting development costs and schedules.

Multi-Chain Architecture: $100,000–$300,000.

Many advanced RWA tokenization platforms integrate numerous blockchain networks to improve efficiency, lower costs, and boost accessibility. Complex bridging technologies and cross-chain communication protocols make multi-chain architecture development expensive and complicated.

The Future of RWA Tokenization

The real world asset tokenization market is expected to increase dramatically, with on-chain assets exceeding $50 billion and reaching $500 billion by 2025. RWA tokenization systems are becoming key infrastructure for global banking as institutional usage accelerates.

Investments will revolve around real estate tokenization, but the potential is vast. Tokenization is changing how we think about ownership, liquidity, and value across asset classes, from art and collectibles to carbon credits and IP.

Cost Breakdown

Cost Category | Estimated Range |

Platform Development | $100,000 – $250,000 |

Security & Audits | $20,000 – $50,000 |

Legal & Compliance | $20,000 – $100,000 |

Secondary Market Integration | $30,000 – $80,000 |

Marketing & Launch | $50,000 – $150,000 |

Annual Maintenance | $20,000 – $80,000 |

Steps to Launch Your RWA Tokenization Platform

Vision: First choose your asset class wisely and market, and also value offer.

Market Research: Before starting the journey with Real Estate Tokenization is the Future of Investments, make sure to examine rivals, regulations, and investor demand.

Select a Model: Then choose the custom or white-label solutions.

Choose a Development Partner: Work with a reputable real-world asset tokenization developer.

Platform Development: Build or configure a secure, compliant, and user-friendly RWA tokenization platform.

Integrate liquidity solutions for smooth trading and secondary market access.

Launch your platform with a solid go-to-market plan.

Maintain and Scale: Support, update, and monitor compliance.

Before staring developing the RWA tokenization platform understand the cost to create a RWA Tokenization platforms.

Benefits of Real Estate Tokenization and Market Opportunities

Here are the benefits of real estate tokenization. Understand real estate tokenization’s benefits and cost to create a RWA Tokenization platforms to justify platform development expenditures and find income prospects. Due to increased liquidity, lower entry barriers, and transparency, real estate tokenization is the future of investing.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Market Size and Growth Projections

Global market potential: $3.7 trillion by 2030

The real estate tokenization market might reach $3.7 trillion by 2030, offering platform developers and operators huge opportunities. Institutional acceptance, regulatory certainty, and alternative investment demand support this expansion.

Investment Benefits:

- Secondary market trading for illiquid assets improves liquidity.

- Reduced Minimum Investments: Fractional ownership allows more involvement.

- Greater Transparency: Transaction and ownership records on blockchain

- Compliance automation: Smart contracts enforce regulations

- Global Access: Digital platforms enable international investment.

Conclusion

The cost to create a RWA tokenization platforms is expensive, but the market opportunity, innovation, and financial inclusion are worth it. Success requires understanding cost drivers, legal requirements, and technology options for real estate tokenization and other asset types.

Asset tokenization is a major change in how we own, exchange, and manage wealth. You can lead this disruptive movement by working with the best real-world asset tokenization development businesses, using innovative RWA tokenization systems, and staying ahead of regulatory developments.

Real estate tokenization is the future of investments; act now. Start planning your RWA tokenization platform immediately with us maximize the tokenized economy.