Stablecoin payments are gaining traction as firms seek reliable digital money transfers. Stablecoins link to assets like dollars, trimming price swings and boosting trust. Growth comes from easier cross-border transfers, automated contract execution, and lower fees than banks charge.

Businesses and individuals use stablecoins to make online payments, handle salaries, and send money across borders. Blockchain records provide clear and secure tracking without using intermediaries. This article looks at what’s driving stablecoin adoption and how automated contracts help power these systems.

The Surreal Growth of Stablecoin Payments in Global Finance

Tipping Point in 2025

How Stablecoins Differ from Bitcoin and ETH?

Real‑World Uses in E‑Commerce, Payroll, Remittances

Breakdown of Stablecoin Types

Top Stablecoins Snapshot and Trends

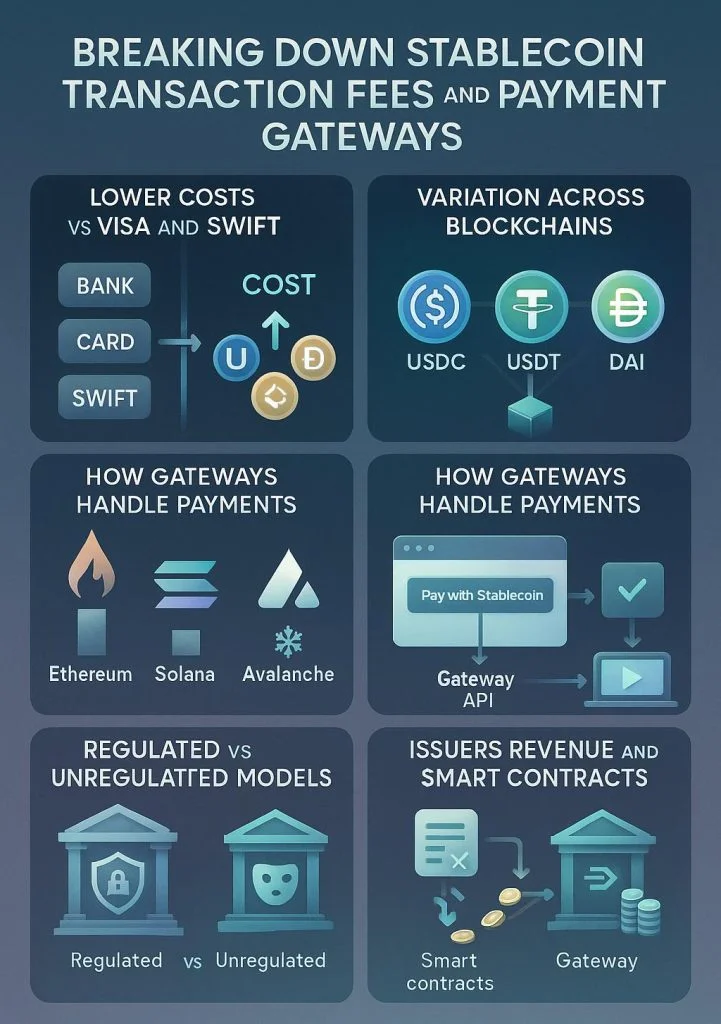

Breaking Down Stablecoin Transaction Fees and Payment Gateways

1. Lower Costs vs Visa and SWIFT

Stablecoin transaction fees run far below card and bank rates because they skip many middle steps. A stablecoin payment gateway plugs into a blockchain network, so payments settle in seconds. Old payment systems stack charges from card issuers, networks, and banks, with each layer adding extra costs.

In contrast, a stablecoin payment gateway routes tokens directly to a recipient address. Validators charge minimal gas or network fees, not percentage slices. This cuts costs and speeds transfers. Many merchants choose this model to let customers pay with stable coins and avoid high bank fees while keeping clear on‑chain records.

2. Variation Across Blockchains

Each blockchain sets its own base charge, so stablecoin transaction fees differ by network load and design. A stablecoin payment gateway on Ethereum must pay higher gas when traffic spikes. On Solana or Avalanche, low congestion keeps charges negligible.

Some chains use proof‑of‑stake, which cuts validator costs and lowers fees further. Gateways switch tokens across chains via bridges or liquidity pools, adding small swap fees. Teams pick gateways that match their speed and cost needs. Comparing chains helps firms forecast fees accurately and integrate the right gateway for their volume and budget.

3. How Gateways Handle Payments

A stablecoin payment gateway acts as middleware between a business and blockchain. Developers embed its API into a checkout page. When a user sends tokens, the gateway watches for confirmations on‑chain. It then triggers a webhook or callback to release goods or services.

Gateways bundle multiple payments into single transactions to lower stablecoin transaction fees further. They also convert fiat invoices into token amounts in real time. Merchants get settled balances in their chosen currency. This model keeps integration simple and avoids handling private keys directly.

4. Regulated vs Unregulated Models

Some gateways operate under strict licenses and meet local stablecoin regulation rules. These providers must perform KYC, maintain reserves, and submit reports. Unregulated gateways let users send tokens without identity checks, offering privacy but risking legal issues. Regulated models often pass audit standards and have insurance plans.

Each model still uses a stablecoin payment gateway to route funds, but compliance costs can raise charges slightly. Businesses in sensitive sectors choose regulated gateways for safety. Others opt for unregulated paths to cut friction. Knowing each option helps teams align with rules and risk tolerance.

5. Issuers’ Revenue and Smart Contracts

Stablecoin issuers earn profit from reserve management and service fees, this shows how stablecoin issuers make money in practice. They invest fiat or assets backing tokens to earn interest. Gateways may share a cut of stablecoin transaction fees with issuers. This explains how stablecoin issuers make money while covering printing and audit costs.

Meanwhile, smart contracts automate fee splits and execute trades only when conditions match, cutting manual work. This automation drives down costs and keeps charges predictable. Together, on‑chain code and token economics let gateways and issuers run smoothly under stablecoin regulation.

Cross-Border Stablecoin Transfers: Use Cases & Challenges

1. Industries and Use Cases

Financial services, trade hubs, and gig platforms leverage cross-border stablecoin transfers for low-cost moves. Remittance firms send funds to emerging markets within minutes, bypassing rail fees. Global employers pay remote staff using stablecoin smart contract development services to trigger payroll at set intervals, replacing bank delays.

Importers settle suppliers directly in tokens, cutting exchange time and hedging currency swings. E‑commerce platforms integrate on‑chain wallets to tap new markets without fiat rails. Each use case exploits the stable value of tokens and transparent ledgers. This boosts trust and cuts reconciliation steps for finance teams handling digital money across countries efficiently globally.

2. KYC/AML and Banking Hurdles

Strict rules around cross-border stablecoin transfers force providers to embed KYC/AML checks and banking rails. Firms must verify user identity before releasing tokens, adding compliance steps. Local banks often block direct token deposits without rationales tied to stablecoin regulation, stalling operations.

Payment platforms integrate identity APIs to scan documents and run background screens, shortening approval from days to hours. Yet, small remitters face high proof demands and manual reviews. Onboarding friction undermines token flows into underserved regions, negating fee benefits. Teams balance faster settlement with scrutiny, aiming to align with regulators while preserving the low-cost promise of digital tokens movement.

3. Speed and Network Congestion

Network fees shift widely during cross-border stablecoin transfers based on chain load and consensus mechanics. High gas on Ethereum spikes charges, while proof-of-stake chains cut costs under congestion. Teams assess multi-chain stablecoin networks such as Solana, Polygon, and Binance Smart Chain to predict consistent transaction costs. Bridges enabling cross-chain stablecoin swaps add liquidity costs and slight slippage, affecting totals.

Payment services adjust routes dynamically to pick low-cost lanes. Developers track mempool size and block timing to schedule transactions for lower fees and faster confirmation. This granular fee view ensures each transfer uses optimal rails, keeping charges predictable and transparent for businesses handling digital currency flows globally systematically efficiently.

4. Interoperability and Compliance

To build robust cross-border stablecoin transfers, teams use stablecoin smart contract development services to code custom rails and automate verifications. Smart contracts handle swaps across multi-chain stablecoin networks, ensuring correct token locks and releases. Cross-chain stablecoin bridges link ledgers without manual steps, keeping trails auditable.

Providers must navigate diverse stablecoin regulation regimes in each jurisdiction, securing licenses and reserve proofs. Compliance scripts in contracts enforce limit checks and disable flows in sanctioned regions. This blend of on-chain code and rule checks shrinks risk and manual audits. Integrating a stablecoin payment gateway with such services yields token movement compliant with rules.

Building the Future: Stablecoin Development, Costs & Services

1. Market Demand for Bespoke Solutions

Global firms push for stablecoin payments in 2025 to cut fees and speed exchanges. A strong need for custom stablecoin development solutions drives growth across finance and trade. Companies look to a stablecoin development company to design tokens that meet rules and handle value moves reliably.

With clear paths to plug tokens into wallets, teams now see these transfers as core for online sales, payroll, and remittances. Choosing tailored solutions ensures tokens fit existing systems. As demand grows, businesses will lean on experts to deliver secure rails for moving stable, digital money easily across borders.

2. Step‑by‑Step Creation Guide for Stablecoin Creation

When building stablecoin payments rails, this guide shows how to create a stablecoin with simple steps. First, set token rules for value backing, then choose a blockchain platform. Next, write the token code and integrate an oracle feed. After that, launch and register your token contract publicly. Finally, audit and deploy with a tight review process.

If you wonder how to create a stablecoin correctly, follow these steps, assign team roles for coding, audit, and compliance, and use simple APIs to link wallets. This roadmap cuts risks and speeds your token launch.

3. Service Comparison and Pricing Tiers

Comparing stablecoin payments and stablecoin development services shows clear tiers: basic code templates, full audits, and white-label interfaces. Entry-level plans cover token code and minimal testing, while premium tiers include compliance checks and ongoing support. A higher stablecoin development services tier offers integration with payment rails and custom dashboards.

Each tier lists its price and features clearly, so teams can pick a plan that fits budget and feature needs. Plans address stablecoin payments needs with transparent pricing, helping businesses forecast fees and avoid surprise charges.

4. Key Cost Factors Explained

Several items drive the cost of stablecoin development and affect stablecoin payments fees. First, security audit depth and lab tests add expenses. Next, smart contract size and features, like minting controls or burning logic, raise charges. Integration with existing payment options or enterprise systems also adds work.

Teams must cover node hosting and gas costs for initial setup. A thorough cost of stablecoin development plan includes reserve audit fees and ongoing support. Using stablecoin smart contract development services that automate testing can cut manual check costs. By mapping each factor, projects can budget accurately and avoid surprise bills.

5. Hiring and Company Selection

Organizations aiming to add stablecoin payments choose a stablecoin development company that has on-chain expertise and clear processes. When you hire stablecoin developers, look for those with experience in token coding, reserve models, and integration. Check that the company can support cross-chain and multi-chain use cases.

You can also hire stablecoin developers skilled in compliance scripting and wallet integration. Ask for case studies showing past launches and uptime records. Rely on certified teams for smooth launches, and get stablecoin development solutions for enterprise scaling. They offer stablecoin smart contract development services to build secure code and streamline tasks through automation.

Conclusion

Stablecoin payments cut fees, speed transfers, and open global markets in 2025’s digital economy. Clear on‑chain records and smart contracts lower risk and operational steps. Growing developer tools and modular frameworks let teams build and scale with agility. Now is the moment for firms to embed stablecoin payment gateway solutions.

Shamla Tech is a stablecoin development company offering custom stablecoin development services. We deliver secure token contracts, compliance checks, oracle integration, and cross‑chain support. Our offerings include cost optimization, performance testing, and ongoing maintenance. Several businesses have benefited from our modular frameworks, audit‑ready reports, API‑driven modules to launch and manage tokens reliably.

Ready to launch secure, scalable stablecoin payments for your business?